Interested in offering clients additional products and services while enjoying the compensation that comes with it? How would you like to strengthen and secure your client relationship by helping the business retain and reward key people? Could your practice benefit from another source of current and future revenue by providing innovative life insurance solutions without the "noise" associated with this line of business (underwriting and ongoing administration)? What if the only invasive question was "are you actively at work?" And finally, any "white collar" client with existing group term in...

The business planning market has never been riper. While the more traditional estate planning market may be a bigger stretch for many advisors, there are close to 30 million small businesses that need your help and they need it now. The issues keeping business owners awake at night have not changed: Concern over losing critical assets – people – themselves or key employeesThe ability to recruit, retain and reward those key employeesEnsuring business continuity and successionRetirement income needsGrowing and protecting personal wealth, with that wealth typically tied up in the business What ha...

Known scientifically as cannabis and commonly referred to as weed, pot, and many other slang terms, marijuana is one of the most widely used recreational drugs in the US today, and is also used in the treatment of various medical disorders. According to the National Survey on Drug Use and Health (United States, 2002-2014), the 18-34 age group has the greatest incidence of marijuana use. What is important to note, however, is the 55 plus age group is showing the greatest increase in use. Males outnumber females in use by 2 to 1. At present, marijuana is legal for recreational use in nine states...

The Tax Cuts and Jobs Act of 2017 introduced some big changes in the tax law, creating both confusion and opportunity for financial planning professionals. You will find links at the end of this blog to several excellent resources that will help you navigate through the three broad categories of life insurance planning that are most dramatically impacted by the new tax laws: Personal insuranceEstate planningBusiness-related insurance But to begin, a review of important tax laws that didn't change. Life insurance death benefits remain income tax-free, with rare exceptions (e.g. transfer for val...

I recently had a conversation with Dusty Farber regarding a business case – one that moved from being "stuck in the mud," to being a bigger deal than originally anticipated. We talked about how so many routine cases could chew up time, often because all the necessary information isn't readily available for clients and advisors to make an informed decision. Dusty gave me an example of exactly this scenario, and the approach he took to get his clients to take action and move forward with not only their business planning but their personal planning as well. Dusty was introduced to two partners wh...

Being fed by our aging producer population, the under-insured and under-served markets, the $15 trillion plus insurance gap, and the search for new and easier ways to access markets—especially the technologically inclined millennials— life insurance companies are beginning to turn the traditional underwriting process on its head. And early results indicate that they are finding some success. Much of what we have seen so far has been positive and a welcome transformation of an otherwise archaic, invasive and time-consuming insurance acquisition process. However, these changes have implications ...

I was very annoyed. It was the first application that I took for a key-person life insurance policy after August 18, 2006. The underwriter kicked the application back because the insured-employee did not sign the "Notice and Consent" form, acknowledging that the employer was both the owner and beneficiary of the policy. When I suggested to the underwriter that we get this signature at delivery, he informed me that the policy would not be issued until the signed "Notice and Consent" was received. This was bull, I never had to get this form in the past. So, what was the big deal? It turns out th...

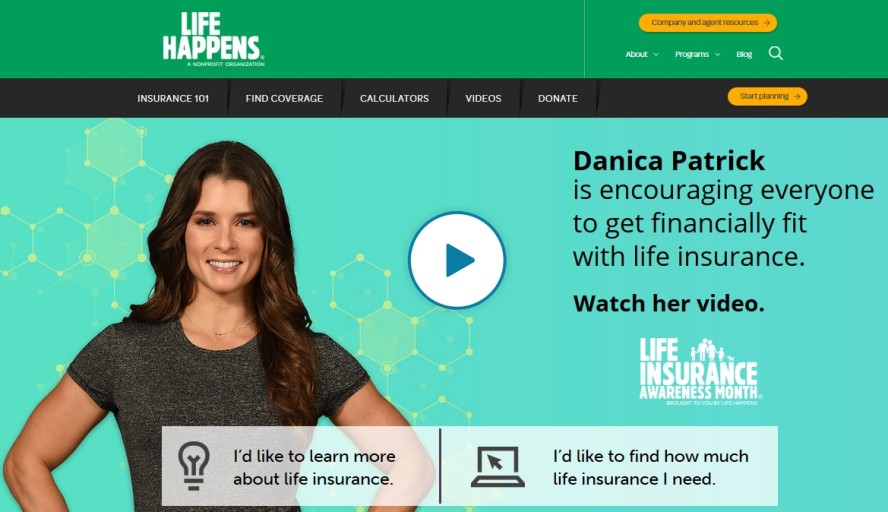

With September's arrival around the corner, our industry once again celebrates Life Insurance Awareness Month (LIAM). Created and produced by LIFE Happens and promoted by carriers and industry organizations, LIAM is a purposeful effort to raise consumer awareness with respect to client vulnerabilities and the solutions we deliver. Go to LIFE Happens to use all of the tools and resources available to help promote LIAM. Danica Patrick is back as LIAM spokesperson with all-new videos promoting financial fitness. For one month each year our industry makes a concerted effort to shine a spotlight on...

The July 20, 2017 Wall Street Journal article, "Happy 100th Birthday! There Goes Your Life Insurance," points out a major hidden flaw in older life insurance contracts: the risk of living too long. In the mid-20th century, the life insurance industry, along with government regulators and actuaries, did not expect or anticipate that more than a handful of policyholders would reach age 100. But today, some insureds fortunate enough to approach these "golden" ages are surprised to learn that their policies will "endow"– that is, coverage will end and any cash values will be paid to the policy own...

A 2014 study by the RAND Corporation estimated the cost of informal caregiving in the US at $522 billion: "Across America, people spend an estimated 30 billion hours every year providing care to elderly relatives and friends. The cost is measured by valuing the times caregivers have given up in order to be able to provide care." Those numbers continue to grow in 2017, as the baby boomer generation ages and creates greater demand for long-term care services. Numbers like this get everyone's attention, and long-term care (LTC) is a concern that is at once personal, cultural and political. Those ...